ruaymak.online Market

Market

Best Zero Turn Mower For 2 Acres

Explore Zero-Turn Mowers · Yellow and black Cub Cadet Ultima ZT1 Zero-Turn Mower. Up to 5 acres · Up to mph · Up to 15 degree slopes. Both engine pulley diameters have been increased so that at 2, RPM the blade tip speed remains consistent and the pump speed allows for 15 MPH top speed—our. The XT1 LT42 from Cub Cadet is a top-notch riding tractor for lawns exceeding two acres. It is highly regarded for its superior performance and reliability. Shop for 1 To 2 Acres Zero Turn Mowers at Tractor Supply Co. Buy online, free in-store pickup. Shop today! Bad Boy · Cub Cadet · Greenworks · Husqvarna · Toro. How to Choose the Right Zero-Turn Mower. To help you find the best zero-. So, equip yourself for success with the best commercial zero-turn mower in the industry. Recommended for under 2 acres; TufDeck™ cutting system. ZT Best Options for Acres ; X LAWN TRACTOR. Powered by 22 hp ( kW)* Cyclonic engine ; X LAWN TRACTOR 48 IN. Powered by 22 hp ( kW)* Cyclonic engine. The ZT Elite Series is a line of zero-turn mowers designed to be easy to use and maneuver. It has been one of the best-selling models since its introduction. We've researched and compared the best zero-turn lawn mowers for homeowners with big properties, including the best for hills and the best electric. Explore Zero-Turn Mowers · Yellow and black Cub Cadet Ultima ZT1 Zero-Turn Mower. Up to 5 acres · Up to mph · Up to 15 degree slopes. Both engine pulley diameters have been increased so that at 2, RPM the blade tip speed remains consistent and the pump speed allows for 15 MPH top speed—our. The XT1 LT42 from Cub Cadet is a top-notch riding tractor for lawns exceeding two acres. It is highly regarded for its superior performance and reliability. Shop for 1 To 2 Acres Zero Turn Mowers at Tractor Supply Co. Buy online, free in-store pickup. Shop today! Bad Boy · Cub Cadet · Greenworks · Husqvarna · Toro. How to Choose the Right Zero-Turn Mower. To help you find the best zero-. So, equip yourself for success with the best commercial zero-turn mower in the industry. Recommended for under 2 acres; TufDeck™ cutting system. ZT Best Options for Acres ; X LAWN TRACTOR. Powered by 22 hp ( kW)* Cyclonic engine ; X LAWN TRACTOR 48 IN. Powered by 22 hp ( kW)* Cyclonic engine. The ZT Elite Series is a line of zero-turn mowers designed to be easy to use and maneuver. It has been one of the best-selling models since its introduction. We've researched and compared the best zero-turn lawn mowers for homeowners with big properties, including the best for hills and the best electric.

2; 3; 4; 5 8. Shop Toro Mowers on Instagram. Use #ToroMowers for a chance How To Choose the Best Riding Lawn Mower. Toro riding mowers are built to. With this electric machine, you can mow up to 2-acres per charge†, fast. The kWh ( kWh maximum) sealed Lithium-Ion Battery is protected from moisture. #2. a cutting width of 60 inches at 5 MPH would net acres per hour so Now if OP is talking a basic homeowners small lawn tractor/lawn mower then go with. Some of the most reviewed products in 2 - 4 Acres Zero Turn Mowers are the Cub Cadet Ultima ZT1 50 in. Fabricated Deck 23HP V-Twin Kawasaki FR Series Engine. Customer Favorites · Cub Cadet 54 in. 24 HP Gas-Powered Ultima Zero-Turn Mower, · Bad Boy 54 in. 26 HP Gas-Powered MZ Magnum Zero-Turn Mower · Cub Cadet 42 in. The XT1 LT42 from Cub Cadet is a top-notch riding tractor for lawns exceeding two acres. It is highly regarded for its superior performance and reliability. Zero-Turn Riding Mowers · Turf Tiger II · Turf Tiger II · Cheetah II · Cheetah II · Tiger Cat II · Tiger Cat II · Patriot · Patriot. Zero Turn Riding Lawn Mowers · Toro TimeCutter in HP Gas Zero-turn Riding Lawn Mower · Toro Zero-Turn-Mowers - View #2 · Toro Zero-Turn-. With options to meet the needs of the most demanding landscape maintenance professionals, our top-rated Exmark Lazer Z X-Series zero-turn mowers represent. Hustler Turf is one of the largest manufacturers of zero-turn mowers with over 55 years of experience. The most complete lineup of residential and. We've researched and compared the best zero-turn lawn mowers for homeowners with big properties, including the best for hills and the best electric. Residential Mowers ; Rex · hp Briggs & Stratton Engine. 34” & 42” decks. 5mph mowing speed · $3, ; Rex MP · 18hp, 20hp Briggs & Stratton Engines. 34”, 42" &. The Best Zero Turn Lawn Mower for 2 Acres - Our Blue Ridge House · Our Blue Ridge House · Best Zero Turn Mower ; 7 Best Zero Turn Mower Reviews for The Perfect. Nothing beats a Hustler for power, precision and agility, makers of the original and best zero-degree turning radius riding mowers. · 42" Cutting Width · 2 Acres. Our nimble residential models are perfect for homeowners who demand professional-grade results, while our heavy-duty commercial beasts tackle acres of tough. When you have a lot of ground to cover and productivity is key, a Ferris zero turn mower with suspension technology is the best choice. From our top-of-the. Whether you own a home or a commercial fleet, you know quality matters when it comes to a riding mower. At Husqvarna, we work tirelessly to deliver the best. Built in the USA, the WZ commercial zero turn mower is the world's largest zero turn mower with a massive " cutting width, five 25” flex decks for. Key Features. Cut up to acres with nearly 10% more power than a 22 HP gas zero turn mower because of Greenworks' cutting-edge brushless technology. Cutting. acres, 3 to 5 acres, and 5 or more acres. This helps you to understand the best lawn mower and deck size for your situation. Two Gravely zero-turn lawn mowers.

Cashing In Life Insurance Taxable

Exempt life insurance enjoys many tax benefits. The death benefit under an exempt policy is tax-free. The accumulation of cash values inside an exempt. Life insurance delivers cash to beneficiaries when it's needed most. Plus, if the policy is properly structured, the beneficiaries receive the death proceeds. A life insurance policy's cash surrender value can be taxable. Any amount you receive over the policy's basis, or the amount you paid in premiums, can be taxed. If you have term life insurance and cancel your contract, there are no tax consequences. You haven't built up cash value, so there isn't anything to tax. But if. You may find yourself needing cash from your life insurance policy. This might occur if you need money for living expenses, educational expenses. Dividends are generally not taxed as income to you. Instead, they are considered a return of your premium regardless of whether you receive them in cash, use. If you withdraw up to the amount of the total premiums paid into the policy, the transaction is not taxable as it is considered a return of premiums. If. The cash value of your whole life insurance policy will not be taxed while it's growing. This is known as “tax deferred,” and it means that your money grows. How Much Tax Do You Pay on a Life Insurance Payout? · 10% if your taxable income is less than $10, · 12% if your taxable income is between $10, to $41, Exempt life insurance enjoys many tax benefits. The death benefit under an exempt policy is tax-free. The accumulation of cash values inside an exempt. Life insurance delivers cash to beneficiaries when it's needed most. Plus, if the policy is properly structured, the beneficiaries receive the death proceeds. A life insurance policy's cash surrender value can be taxable. Any amount you receive over the policy's basis, or the amount you paid in premiums, can be taxed. If you have term life insurance and cancel your contract, there are no tax consequences. You haven't built up cash value, so there isn't anything to tax. But if. You may find yourself needing cash from your life insurance policy. This might occur if you need money for living expenses, educational expenses. Dividends are generally not taxed as income to you. Instead, they are considered a return of your premium regardless of whether you receive them in cash, use. If you withdraw up to the amount of the total premiums paid into the policy, the transaction is not taxable as it is considered a return of premiums. If. The cash value of your whole life insurance policy will not be taxed while it's growing. This is known as “tax deferred,” and it means that your money grows. How Much Tax Do You Pay on a Life Insurance Payout? · 10% if your taxable income is less than $10, · 12% if your taxable income is between $10, to $41,

For the most part, beneficiaries don't need to pay taxes on the life insurance death benefit they receive, especially if they receive it as a lump sum. However. Federal Income Taxes – Any earnings on the cash value of the insurance policy may be taxable as income. So, if you have had $10, in earnings in your policy. You will owe taxes on (k) distributions, but you can generally access your insurance policy's cash value federal income tax free. The cash value isn't just. Withdrawal: In many situations, you can take a cash withdrawal from your permanent life policy, and that money is often not subject to income taxes as long as. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to. The gain you realize on the policy sale could be ordinary income, capital gain or both, the determination of which is primarily dependent on the cash surrender. Since life insurance proceeds generally are not taxable, your beneficiary should receive the full amount of the policy subject to common death benefit. Essentially, you can withdraw the amount of money equivalent to the amount you've paid in premiums tax-free. However, if the cash value—the amount you receive. However, the surrender of an insurance policy or endowment contract for its cash surrender value, as distinguished from an exchange of policies or contracts. If your policy does allow such withdrawals, any withdrawal you make will typically be tax free up to your basis in the policy. Your basis is the amount of. Only distributions that exceed the policy's cost basis are subject to income tax. Distributions can be used for any reason without affecting the tax. Life insurance proceeds paid in a lump sum are generally received by the beneficiary tax-free. This includes term, whole, and universal life insurance. However. In most cases, money you get for selling your policy is not taxable. However, if you profit from the sale, you may be subject to income and capital gains taxes. As a general rule, a life insurance payout is tax-free. When you die, your beneficiaries usually won't have to pay taxes on the life insurance death benefit. Term life insurance is the most straight forward option with regards to understanding the tax implications – basically, you pay for your policy coverage which. You should receive a Form R showing the total proceeds and the taxable part. Report these amounts on lines 5a and 5b of Form or SR. To report the. However, the surrender of an insurance policy or endowment contract for its cash surrender value, as distinguished from an exchange of policies or contracts. Regarding the portion that is withdrawn, a portion or even the full amount could be considered taxable. When the CSV is more than the ACB it triggers a taxable. Key Takeaways · In a typical situation, inherited money from a life insurance policy beneficiary is not taxed as income. · In some cases, a beneficiary may have. Yes, there are penalties for cashing out your life insurance. Your deduction may be subject to taxes or surrender fees, depending on your plan. Any money cashed.

Point Of Sale Purchase Meaning

A POS or “Point of Sale” transaction is a purchase made with your Visa debit card and you are required to enter your PIN on a keypad. POS transactions post. You may also use your Card to conduct purchase transactions directly with a merchant who accepts your Card; these transactions are commonly referred to as Point. The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant. At its most basic level, a POS system calculates the total of a customer's purchase, facilitates payment processing (through integrated payment hardware), and. A point-of-sale (POS) system is a device that customers use to check out and pay for their purchases. POS data is the information that's collected during the customer sales transaction. Your POS system manages every shopper purchase in-store, online, or on. A point of sale, or point of purchase, is where you ring up customers and accept payments. When customers check out online, walk up to your checkout counter. 1. Record the items being purchased. First, the customer presents the items they want to purchase to the cashier. This usually means that the shopper brings the. POS, or point of sale, refers to the specific area where the exchange of goods takes place. For example, the point of purchase for a loaf of bread is a grocery. A POS or “Point of Sale” transaction is a purchase made with your Visa debit card and you are required to enter your PIN on a keypad. POS transactions post. You may also use your Card to conduct purchase transactions directly with a merchant who accepts your Card; these transactions are commonly referred to as Point. The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant. At its most basic level, a POS system calculates the total of a customer's purchase, facilitates payment processing (through integrated payment hardware), and. A point-of-sale (POS) system is a device that customers use to check out and pay for their purchases. POS data is the information that's collected during the customer sales transaction. Your POS system manages every shopper purchase in-store, online, or on. A point of sale, or point of purchase, is where you ring up customers and accept payments. When customers check out online, walk up to your checkout counter. 1. Record the items being purchased. First, the customer presents the items they want to purchase to the cashier. This usually means that the shopper brings the. POS, or point of sale, refers to the specific area where the exchange of goods takes place. For example, the point of purchase for a loaf of bread is a grocery.

POS hardware · Touchscreen monitors or tablets: Monitors display the product database, allow businesses to record purchases and provide customers with a receipt. POS Full Form, POS Meaning. Point of Sale (POS) is where a customer completes the purchase of goods or services. These transactions at the cash register in. A signed purchase POS is transactions completed at a Point of Sale where customers authorize their purchases by providing a signature. The right POS software can be a workhorse, allowing customers to easily purchase their items and provide business owners with access to crucial data. Whether. A point of sale (POS) transaction signifies the pivotal moment when a customer engages in a purchase at a tangible brick-and-mortar store, employing either. A POS machine is a terminal of some kind that you use at the point of sale to record transactions. This could be as simple as a card-processing terminal so. The seller will then provide the buyer with an invoice (this isn't always applicable) and methods for completing the purchase. The last step of the “point of. In business terms, POS means Point of Sale. A point-of-sale (POS) system is defined as the device used to complete a sales transaction and is a combination. Point of sale systems help businesses conduct transactions with their customers, primarily for purchases and payments. More sophisticated POS systems can also. In the realm of retail and business transactions, point of sale (POS) refers to the specific location and moment where a customer completes a purchase and pays. Every sale that goes through the point-of-sale system is technically a POS transaction. So why are debit card purchases singled out as POS debit? The merchant. What Is a POS Transaction? At its most basic level, a POS transaction is defined as the moment when an exchange of a product or service for payment is. The point of purchase is the time and/or place in a customer's buying journey where all elements of the sale come together: the customer, the money, and the. Point of sale terminals are strategically placed in a business setting because consumers are more likely to make purchasing decisions closer to these locations. The point of sale is the place in a store where a product is passed from the seller to the customer. The abbreviation POS is also used. [business]. A point of sale (POS) transaction occurs when a customer makes a purchase and completes payment at a physical or virtual checkout location. First of all, POS is an acronym – no, not that acronym. It stands for “point of sale,” which can be defined as the place where a transaction takes place between. POS (point of sale) refers to the time and location of the purchase or the in-store digital devices used to process and record payments, such as PCs or. POS hardware · Touchscreen monitors or tablets: Monitors display the product database, allow businesses to record purchases and provide customers with a receipt. designating or in use at a point of sale, cashier's desk, or checkout counter; point-of-purchase. (in retailing) of or relating to a customer-checkout system.

Accounting Software For Transport Business

This detailed guide will help you find and buy the right trucking accounting software for you and your business. Last Updated on August. Try Rigbooks risk-free for 30 days and gain total control over your trucking business. Rigbooks puts profit and loss reports, expense and fuel mileage reports. With the help of FreshBooks transport accounting software, you can track all of your transactions, accounts payable, and accounts receivable any minute of the. Find and compare the best Trucking Accounting software in · QuickBooks Online · Sage Intacct · AccountEdge · NolaPro · BizAutomation · TopNotepad · Patriot. Get the best overview of your supply chain and performance with our online accounting software that keeps up with how you do business. transport solutions. Quickbooks offers a range of key features that make it an excellent choice for trucking companies. It provides robust invoicing and billing functionalities. The best accounting software for trucking companies includes TruckLogics, Q7, Rigbooks, Axon, TruckBytes, TruckingOffice and Zoho Books. ZarMoney provides an all-in-one solution that covers all your accounting needs. This specialized transport accounting software is designed to streamline your. Our Trucking Accounting software helps manage all your financial process like invoices, payments, & more easily. TruckLogics provides real-time reports such. This detailed guide will help you find and buy the right trucking accounting software for you and your business. Last Updated on August. Try Rigbooks risk-free for 30 days and gain total control over your trucking business. Rigbooks puts profit and loss reports, expense and fuel mileage reports. With the help of FreshBooks transport accounting software, you can track all of your transactions, accounts payable, and accounts receivable any minute of the. Find and compare the best Trucking Accounting software in · QuickBooks Online · Sage Intacct · AccountEdge · NolaPro · BizAutomation · TopNotepad · Patriot. Get the best overview of your supply chain and performance with our online accounting software that keeps up with how you do business. transport solutions. Quickbooks offers a range of key features that make it an excellent choice for trucking companies. It provides robust invoicing and billing functionalities. The best accounting software for trucking companies includes TruckLogics, Q7, Rigbooks, Axon, TruckBytes, TruckingOffice and Zoho Books. ZarMoney provides an all-in-one solution that covers all your accounting needs. This specialized transport accounting software is designed to streamline your. Our Trucking Accounting software helps manage all your financial process like invoices, payments, & more easily. TruckLogics provides real-time reports such.

This article discusses some of the best software solutions that are specifically designed to do accounting for the trucking business. Sage Accounting Standard is a good choice for transport companies, couriers and taxi drivers. It simplifies recording income and expenses and enables. Customizable accounting software with features tailored for trucking and transportation companies, supported by our Certified QuickBooks ProAdvisors. Provides. Transportation Management Software with Accounting · PCS TMS · Tai TMS · Alvys TMS · Axon Trucking Software · Truckbase · PortPro · Descartes Aljex · Tecsys. Learn how Sage Intacct software can drive accounting for trucking companies, airlines and other transport services, saving you time and money. PCS provides an all-in-one transportation management system for multimodal, Truckload, LTL, Intermodal and Freight Brokerage companies. Invoicing can be complex and time-consuming. That's why you need a transportation management software that works with your trucking accounting software — like. The days of cell phones and email are a thing of the past. Become a business driven by data by adopting state-of-the-art trucking accounting software. Make. Benefits for Trucking Companies · Efficiency and accuracy: Automating financial tasks minimizes the potential for human error and streamlines the accounting. myBillBook helps Business succeed · “Managing delivery challans and quotations is a breeze with myBillBook. · “The e-way billing feature is a game-changer for us. Truck accounting software is an essential tool for trucking companies. It allows companies to track expenses, income, and profits accurately. Whether you're transporting goods by land, sea, or air, Accounting Seed can help manage your freight operations and shipping lifecycle finances in. The Full Truckload Transport Software is capable to manage full truckload dispatching operation. The Full Truckload Software assist the logistics and. With Trucking Pro Software, you can easily manage your loads, track expenses, and stay on top of your income. Take control of your business and make your life. Here is simple accounting software for transport business. It is a complete solution for estimating, invoicing and accounting. Transport business can create. Access Financials is designed to meet the needs of logistics and transport companies. It streamlines financial processes and provides a comprehensive overview. Top 9 Bookkeeping Software for Truckers · Truckn Pro Intro: · Tailwind Intro: · ProTransport Intro · Q7 Trucking Software Intro: · Truckers Bytes TMS intro. Trucking software helps trucking companies store electronic records and manage day-to-day operations. Truck company administrators and managers use trucking. Grow your transport business with Big Red Book's transport accounting software which helps transport businesses run a more efficient & profitable business. Xero and QuickBooks are cloud-based accounting software platforms used by businesses for managing their finances, including tasks such as invoicing, bookkeeping.

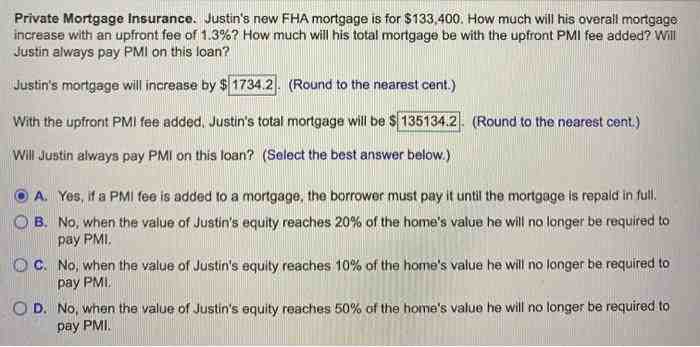

How To Get Pmi Off Fha Loan

With an FHA case number assignment date on or after June 3, , the FHA insurance can be terminated by the servicer or holder if the mortgage is paid in full. The ability to cancel — Generally, PMI can be removed from your monthly mortgage payment when you've reached 20% equity in your home or have paid your loan. Ask to cancel your PMI: If your loan has met certain conditions and your loan to original value (LTOV) ratio falls below 80%, you may submit a written request. MIP Rates for FHA Loans Over 15 Years. If you take out a typical year mortgage or anything greater than 15 years, your annual mortgage insurance premium. Additionally, if you reach the halfway point of your repayment term — 15 years on a year loan, for example — the PMI will drop off regardless of the. PMI is often interchanged with MIP. You can get rid of PMI on The FHA "may" go away. Can you remove mortgage insurance from an FHA loan? On. Most lenders allow you to drop the PMI if you pay your loan down enough to where you owe less than 80% of value. Sometimes you might have to. MIP, on the other hand, is for FHA loans and has different rules for MIP removal. Insurance stays on for the life of the loan unless you make a 10% down payment. FHA insures mortgages so that lenders will be encouraged to make more mortgages available for people. The FHA mortgage insurance agreement is between FHA and. With an FHA case number assignment date on or after June 3, , the FHA insurance can be terminated by the servicer or holder if the mortgage is paid in full. The ability to cancel — Generally, PMI can be removed from your monthly mortgage payment when you've reached 20% equity in your home or have paid your loan. Ask to cancel your PMI: If your loan has met certain conditions and your loan to original value (LTOV) ratio falls below 80%, you may submit a written request. MIP Rates for FHA Loans Over 15 Years. If you take out a typical year mortgage or anything greater than 15 years, your annual mortgage insurance premium. Additionally, if you reach the halfway point of your repayment term — 15 years on a year loan, for example — the PMI will drop off regardless of the. PMI is often interchanged with MIP. You can get rid of PMI on The FHA "may" go away. Can you remove mortgage insurance from an FHA loan? On. Most lenders allow you to drop the PMI if you pay your loan down enough to where you owe less than 80% of value. Sometimes you might have to. MIP, on the other hand, is for FHA loans and has different rules for MIP removal. Insurance stays on for the life of the loan unless you make a 10% down payment. FHA insures mortgages so that lenders will be encouraged to make more mortgages available for people. The FHA mortgage insurance agreement is between FHA and.

I was wondering please, Can you have the PMI removed from your FHA loan, SO LONG AS you have " Less Than " 80% LTV on your Primary Residence (so a. Borrowers may request cancellation of a mortgage insurance policy by writing the current lender asking for a review and removal of PMI. For conventional mortgages, you'll need to wait until you have at least 20% equity to have your PMI removed by your lender. When it comes to FHA MIP, if a. Depending on when you first took out the loan and your down payment, MIP can last anywhere from 11 years to the life of the loan. While MIP doesn't fall off. The FHA mortgage insurance agreement is between FHA and the mortgage company, so you must contact your mortgage company and ask them what they require to drop. The ability to remove FHA mortgage insurance depends on your loan origination date and size of your down payment. · If you got your FHA loan after the year For homeowners with FHA loans issued after June , you must refinance into a conventional loan and have a current loan-to-value of at 80% or greater. The other primary option for getting rid of FHA mortgage insurance is to put down at least 10% upfront. If you do, your lender should automatically cancel your. But PMI can be removed, and it is up to the borrower to see out and ask for the removal. If not, the PMI Company will continue to take your money each and every. Previously, mortgage insurance was eligible to be removed (by the borrower) from your mortgage portfolio after you built 20% of equity in the home. At 78% loan-. You may not be able to remove PMI by refinancing unless you have at least 20% equity in your home. The rules for removal of MIP are different for FHA loans and. To permanently get rid of MIP, borrowers can refinance out of an FHA loan and into a conventional loan. There is no requirement that borrowers refinance from an. Many customers ask us if FHA loans have mortgage insurance which they often call "PMI," which stands for private mortgage insurance. You are required to pay. If you make the minimum down payment of % for an FHA loan (or anything in that range), you'll probably have to pay the annual MIP until you either pay off or. Unlike FHA mortgage insurance, borrower-paid mortgage insurance (BPMI) can be canceled. That's a good thing because it can lower your monthly mortgage payment. To permanently get rid of MIP, borrowers can refinance out of an FHA loan and into a conventional loan. There is no requirement that borrowers refinance from an. For example, some lenders may agree to cancel PMI based on the home's current value if you have made substantial improvements to it; others may elect to cancel. Previously, mortgage insurance was eligible to be removed (by the borrower) from your mortgage portfolio after you built 20% of equity in the home. At 78% loan-. For homeowners with FHA loans issued after June , you must refinance into a conventional loan and have a current loan-to-value of at 80% or greater. You can request to have PMI removed from your loan when your balance reaches 80% loan-to-value (LTV) based on the original value.

Cost To Refinish Cast Iron Bathtub

The cost to refinish a cast iron tub runs between $ and $, depending on the size and condition of the tub. Refinishing a cast iron tub costs more than. cost effective way to beautify your bathroom. Get Your Amazing job done with my bathtub refinish. Had a fiberglass cover over an existing cast iron tub. Cost is about $3, You need to remove tub, remove wall finish and install water proof stuff plus a wall finish. If you need an architect to. My bathtub has been refinished before. I refinish steel and cast-iron bathtubs weekly with prior coatings for an additional $50 fee. I do not refinish. This procedure on cast iron or steel tubs is usually called porcelain bathtub Can I reglaze/ refinish a bathtub that was already painted? Yes. A. Ever wonder how long does bathtub refinishing last or how much does tub refinishing cost? cast iron, fiberglass, and acrylic can be refinished. However. Minor Bathroom Remodel:Cost Range: $3, to $12,Scope: This might include cosmetic updates such as replacing fixtures, painting, updating. Tub Resurfacing Costs by Material · Porcelain Tub Reglazing Cost. Reglazing a porcelain tub costs $ on average. · Cast Iron Tub Refinishing. Refinishing a cast. Conversely, refinishing a bathtub in Calgary usually costs somewhere between $–$, which means even the most expensive refinishing jobs are less expensive. The cost to refinish a cast iron tub runs between $ and $, depending on the size and condition of the tub. Refinishing a cast iron tub costs more than. cost effective way to beautify your bathroom. Get Your Amazing job done with my bathtub refinish. Had a fiberglass cover over an existing cast iron tub. Cost is about $3, You need to remove tub, remove wall finish and install water proof stuff plus a wall finish. If you need an architect to. My bathtub has been refinished before. I refinish steel and cast-iron bathtubs weekly with prior coatings for an additional $50 fee. I do not refinish. This procedure on cast iron or steel tubs is usually called porcelain bathtub Can I reglaze/ refinish a bathtub that was already painted? Yes. A. Ever wonder how long does bathtub refinishing last or how much does tub refinishing cost? cast iron, fiberglass, and acrylic can be refinished. However. Minor Bathroom Remodel:Cost Range: $3, to $12,Scope: This might include cosmetic updates such as replacing fixtures, painting, updating. Tub Resurfacing Costs by Material · Porcelain Tub Reglazing Cost. Reglazing a porcelain tub costs $ on average. · Cast Iron Tub Refinishing. Refinishing a cast. Conversely, refinishing a bathtub in Calgary usually costs somewhere between $–$, which means even the most expensive refinishing jobs are less expensive.

If the tub has never been refinished before, it will cost $ Newer acrylic tubs can also be designed to resemble a cast iron clawfoot tub. Man Made Marble . The National Kitchen and Bath Association recently estimated that a full bathtub replacement can cost well over $3, in labor and supplies. Performing a total. Our prices start as low as $ for standard porcelain bathtub refinishing. Same starting price for fiberglass and cast iron. We also include a 3 year guarantee. We refinish all types of tubs: Porcelain, cast iron, fiberglass, steel. Low Cost: Your tub refinishing cost is but a fraction compared to purchasing a. Our bathtub refinishing prices are reasonable and low. Cost to refinish a standard metal or cast iron bathtub that has never been refinished before is just $. Cast Iron Bathtub Refinishing In Orlando ruaymak.online Cost Comparison Yes, refinishing and reglazing are significantly more cost-effective than replacing. Transform your bathroom with our cost-effective bathtub reglazing and refinishing services in NYC Can you refinish cast iron, steel, and acrylic tubs? Yes, we. The average cost to refinish a bathtub is $, compared to $3, to replace it. You have a cast iron bathtub that is heavy and expensive to dispose of. You. refinishing processes that offer lower quality and less durability. Both enameled cast iron and acrylic bathtubs with a worn surface can be restored to. Bathtub refinishing, also referred to as resurfacing or reglazing, is a cost We proudly refinish any of the following surfaces. Acrylic; Cast Iron; Cultured. How Much Does Bathtub Refinishing Cost? · Fiberglass bathtub repair: $ – $1, on average · Porcelain bathtub repair: $ – $ on average · Cast iron. The average time averages around 2 to 3 hours, including all the steps of the bathtub refinishing process: acid wash, deep clean-up, removal of the old caulking. If your present tub is porcelain over cast iron, it is far superior quality than the low-priced replacement tubs on the market today. Our price for an. $ to $ price to replace a tub. Most homeowners do not know all the work involved in the replacement of a bathtub. 2. Fast service. Most tubs get done. Cast Iron Bathtub Refinishing In Orlando ruaymak.online Cost Comparison: Bathtub Replacement vs. Refinishing. Average Bathtub Replacement Costs is $1, The basic cost to Refinish Bathtub is $ - $ per bathtub in April , but can vary significantly with site conditions and options. The typical cost to refinish a bathtub is about $ While bathtub refinishing can range in price from about $ to $, a high-end project can cost up to. Renew-It Refinishing offers three different levels of tub refinishing service. Basic, Deluxe and our Best Bathtub Refinishing. Ever wonder how long does bathtub. If you research prices online, you'll quickly learn that cast Iron bathtubs can cost $ to $, which is a sizable investment for a bathroom refresh. Whether you have a cast iron, fiberglass, or acrylic tub, our team is equipped to handle it all. Experience the difference with Fresh Look Refinishing and enjoy.

Most User Friendly Accounting Software

Sage If you're looking for robust reporting and deep data-driven insights, Sage 50 is the accounting software for you. Starting at $ per month, Sage Best 9 Accounting Softwares for Small Businesses in ; #1) QuickBooks Online. Best Small Business Accounting Software Overall · Built-in reporting with a. Best accounting software. FreshBooks: Best if you want to scale your business. Zoho Books: Most affordable. Intuit QuickBooks Online: Best if you'. For most, however, it's worth checking out QuickBooks Online. It's the most-used accounting software out there, and it has the tools that most will need to run. List of Best Accounting Software · FreshBooks · Zoho Books · Microsoft Dynamics Business Central · Oracle Accounting Hub Cloud · QuickBooks Online · QuickBooks. QuickBooks has served small businesses for more than 20 years and is the leading brand name in accounting software. When you choose QuickBooks, you get all the. Make tracking receipts, income, bank transactions, and more feel simple with the #1 small business accounting software See plans & features. Unlike most of the other accounting software for small businesses, GnuCash is an open-source option that can work for both personal and small business use. Sage and Quickbooks are both good. Sage is about R per month for 1 company 2 users. Sage If you're looking for robust reporting and deep data-driven insights, Sage 50 is the accounting software for you. Starting at $ per month, Sage Best 9 Accounting Softwares for Small Businesses in ; #1) QuickBooks Online. Best Small Business Accounting Software Overall · Built-in reporting with a. Best accounting software. FreshBooks: Best if you want to scale your business. Zoho Books: Most affordable. Intuit QuickBooks Online: Best if you'. For most, however, it's worth checking out QuickBooks Online. It's the most-used accounting software out there, and it has the tools that most will need to run. List of Best Accounting Software · FreshBooks · Zoho Books · Microsoft Dynamics Business Central · Oracle Accounting Hub Cloud · QuickBooks Online · QuickBooks. QuickBooks has served small businesses for more than 20 years and is the leading brand name in accounting software. When you choose QuickBooks, you get all the. Make tracking receipts, income, bank transactions, and more feel simple with the #1 small business accounting software See plans & features. Unlike most of the other accounting software for small businesses, GnuCash is an open-source option that can work for both personal and small business use. Sage and Quickbooks are both good. Sage is about R per month for 1 company 2 users.

Zoho Books offers free accounting software for small businesses with turnover below $50K. Try the best free online accounting software now! Xero is another cloud-based accounting software for travel agencies. It offers similar features to QuickBooks Online but with a more user-friendly interface. Accounting software can sound and look boring, but FreshBooks is a great example of how it can be quirky and fun. When you start out, most of the pages will. QuickBooks has served small businesses for more than 20 years and is the leading brand name in accounting software. When you choose QuickBooks, you get all the. NetSuite. 15 Best Accounting Software in NetSuite is a cloud-based software that offers a suite of ERP applications, financials, inventory management. Get started using best-in-class accounting software for small business with a free day trial. FreshBooks lets you test out our easy-to-use features for a. Most small business operators will be familiar with accounting software aimed at that segment, the most popular of which might arguably be Intuit QuickBooks. 1. Quickbooks Software This accounting software is the most reasonably priced option on the market. However, this comes with the knowledge that QuickBooks. Most small business operators will be familiar with accounting software aimed at that segment, the most popular of which might arguably be Intuit QuickBooks. List of Best Accounting Software · FreshBooks · Zoho Books · Microsoft Dynamics Business Central · Oracle Accounting Hub Cloud · QuickBooks Online · QuickBooks. Sage Intacct is a cloud-based financial management software that is used for tasks such as payment processing, reporting, and maintaining accounting records. Accounting Software · NetSuite · Workday Financial Management · Rightworks OneSpace Firm · Zoho Books · CosmoLex · Accounting Seed · Odoo · Xero. All of those finance professionals need to be able to use the system, and that's why QuickBooks is the best accounting software if you are an early-stage. Why I Picked Quickbooks: Quickbooks continues to be the most widely used accounting software among small business owners. It's easy to set up and use—you. This is an all-in-one accounting software solution with invoicing, inventory management, billing, and payment capabilities. You can use it to create and send. Get started using best-in-class accounting software for small business with a free day trial. FreshBooks lets you test out our easy-to-use features for a. For most, however, it's worth checking out QuickBooks Online. It's the most-used accounting software out there, and it has the tools that most will need to run. All of those finance professionals need to be able to use the system, and that's why QuickBooks is the best accounting software if you are an early-stage. The 'Infinite' plan offers everything unlimited at ₹/Year. The most popular 'Enterprise' plan costs ₹/Year. Small and medium-sized businesses can. Two popular programs in small business accounting are QuickBooks Desktop and Sage 50cloud. QuickBooks Desktop is available in three tiers with pricing based on.

Best Software For Developing Websites

We present an ultimate list of web design tools, including free website builders & professional programs. Create custom, responsive websites with the power of code — visually. Design and build your site with a flexible CMS and top-tier hosting. 10 Best Web Design Software Shortlist · 1. Canva — Best drag-and-drop website builder · 2. Figma — Best web design software with robust cross-functional. Shift4Shop is the perfect solution for getting up and running online quickly. With a powerful, intuitive CMS, support for multiple website page types. Best software for website design for beginners? · Figma · Adobe Xd · Adobe Dreamweaver. Note: I have no coding experience and no web designing. Website builder software helps users create websites without the need for coding. Its user-friendly design tools and templates, combined with plugins that can. Google Sites for basic sites (without SEO). Yola for simple, no-fuss websites. Wix for an all-around site builder. HubSpot CMS for growing businesses. List of the Best Web Design Software with Reviews · Wordpress. (42 Reviews) Verified · BOWWE. (28 Reviews) Verified · Adobe Photoshop. (24 Reviews). Discover the best software and tools for website design and development. Build your website with the help of vetted, experienced software developers. We present an ultimate list of web design tools, including free website builders & professional programs. Create custom, responsive websites with the power of code — visually. Design and build your site with a flexible CMS and top-tier hosting. 10 Best Web Design Software Shortlist · 1. Canva — Best drag-and-drop website builder · 2. Figma — Best web design software with robust cross-functional. Shift4Shop is the perfect solution for getting up and running online quickly. With a powerful, intuitive CMS, support for multiple website page types. Best software for website design for beginners? · Figma · Adobe Xd · Adobe Dreamweaver. Note: I have no coding experience and no web designing. Website builder software helps users create websites without the need for coding. Its user-friendly design tools and templates, combined with plugins that can. Google Sites for basic sites (without SEO). Yola for simple, no-fuss websites. Wix for an all-around site builder. HubSpot CMS for growing businesses. List of the Best Web Design Software with Reviews · Wordpress. (42 Reviews) Verified · BOWWE. (28 Reviews) Verified · Adobe Photoshop. (24 Reviews). Discover the best software and tools for website design and development. Build your website with the help of vetted, experienced software developers.

Shift4Shop is the perfect solution for getting up and running online quickly. With a powerful, intuitive CMS, support for multiple website page types. Emergent Software is a top web development company that combines the expertise of complex web development services with quality, mobile friendly web design. Emergent Software is a top web development company that combines the expertise of complex web development services with quality, mobile friendly web design. We're going to highlight 13 of the best website builders of to help you get a professional-looking website in no time. Based on my experience, there are several fantastic website design tools to consider, including Figma, Adobe XD, Sketch, Webflow, and Canva. Read our guide to the best web design software in so you can quickly find the right solution for your skillset, needs and budget. Are you looking for the best free web design software to create a great design or build a website? Check out this list of web design software that are open. We've put together a list of the best professional web design software and resources available today, sorted by category. As of June , ruaymak.online is the most visited Computer Software and Development website in the World, attracting B monthly visits. ruaymak.online follows. NetObjects Fusion is powerful Website Design Software that has earned critical praise and worldwide recognition as one of the fastest, easiest ways to build. Wix is a website creation platform that allows users to build websites using a drag-and-drop interface and offers a range of templates and features. Similar to Wix, the website creation software SiteW allows you to create a simple website for free, from templates. It is also accessible from a distance. You. List of the Top Web Design Software · Wix · Squarespace · Webador · Pixpa · Strikingly · Adobe Dreamweaver · Mobirise · Webflow; GIMP; Sketch; WordPress. Start building today · ChromeOS logo. Chrome. Modern tools and features that help you build high-quality web experiences. · Firebase logo. Firebase. An app. Website builders are programs that allow you to create and publish websites. Many of these website builders are hosted online and are very easy to use since. Google Web Designer gives you the power to create beautiful and compelling videos, images, and HTML5 ads. Use animation and interactive elements. My overall favorite was Wix, mainly because of the high-quality of their templates and their easy to use website builder. Squarespace offers clean and professional websites for your business and is one of the most popular web design software tools. You can build a professional. Quickly create and publish web pages almost anywhere with Adobe Dreamweaver responsive web design software that supports HTML, CSS, JavaScript, and more. Code and program your website yourself.

Cheapest Time Of The Week To Fly

The data reveals February and April as the two most expensive months to fly while November and January seem to be the cheapest. Some will say mid-week flights on Tuesday, Wednesday, and Thursday are the cheapest. Others will tell you to take a "red-eye" all night flight to save the most. Tuesdays and Wednesdays are often the best days to find deals, and flying on weekdays can also be cheaper than weekends. Additionally, using price comparison. Airfares offered on Thursdays tend to be the cheapest, according to flight demand on Travelocity in Tuesday and Wednesday prices are also good. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. For both U.S. domestic and international travel, Sundays can be cheaper for airline ticket purchases. Fridays tend to be the most expensive day to book a flight. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least. According to our data, Sunday is the cheapest day of the week to book flights, but once again, it depends on your destination. If you are flexible around what. A study of domestic flight pricing reveals you'll want to book your flight between four months and three weeks before your domestic trip. The data reveals February and April as the two most expensive months to fly while November and January seem to be the cheapest. Some will say mid-week flights on Tuesday, Wednesday, and Thursday are the cheapest. Others will tell you to take a "red-eye" all night flight to save the most. Tuesdays and Wednesdays are often the best days to find deals, and flying on weekdays can also be cheaper than weekends. Additionally, using price comparison. Airfares offered on Thursdays tend to be the cheapest, according to flight demand on Travelocity in Tuesday and Wednesday prices are also good. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. For both U.S. domestic and international travel, Sundays can be cheaper for airline ticket purchases. Fridays tend to be the most expensive day to book a flight. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least. According to our data, Sunday is the cheapest day of the week to book flights, but once again, it depends on your destination. If you are flexible around what. A study of domestic flight pricing reveals you'll want to book your flight between four months and three weeks before your domestic trip.

What is the cheapest day to buy plane tickets? Any day of the week. Booking on one day versus another isn't going to make a difference. "That used to be true;. Rule of thumb: Friday and Sunday tend to be popular. As a result, you may find that the cheapest time to fly is in the middle of the week. That said, the travel. By booking to fly Friday morning instead of Friday night, or by returning earlier on Sunday than you'd initially planned, you can often snag a much better. Note: You can consider booking your flights on mid days of the week like Tuesdays and Wednesdays (best days to buy flights). Specifically, Tuesday is considered. Keyes says this is mainly because business travelers tend to avoid traveling in the middle of the week. Early morning flights are also less popular since people. Day of the Week: Tuesdays and Wednesdays are often cheaper. Seasonality: Avoid peak seasons for lower fares. Time of Day: Early morning or late-. Ask anyone the best day of the week for booking flights and they will probably say Tuesday. Is this actually true or an urban myth? To some extent, it is true. So, when is the best time to book your flight? The cheapest days to fly are often in the middle of the week, with Fridays and Sundays being the most expensive. Lower demand isn't the only reason travel experts back Tuesdays and Wednesdays as the cheapest days to fly. Several articles suggest airlines are likely to. Secret Tip #2 – Weekdays are cheaper Long-haul flights that leave on a Thursday and return on a Monday typically cost about 20% less than flights that leave. The Cheapest Day to Buy a Domestic Flight is on a Thursday · The Cheapest Day to Fly Domestic is on a Wednesday · The Cheapest Day to Return Domestic is on a. International flights are usually cheaper on weekdays, while you will usually find the airfare is cheaper for internal flights if you book on a Tuesday. The Cheapest Day to Fly to Europe is on a Wednesday. When it comes to saving dollars on departures, it may be worth aligning your exodus from the United States. What is the cheapest day of the week to book a flight? The best day to book months, the cheapest day to fly for domestic flights is Wednesday. For. In general, the "sweet spot" for Southwest fares during non-peak travel times is weeks out. Fares are high when the schedule is first release, tend to. Booking flights in advance can help with finding the best rates on rates. · Flying midweek or on Saturdays generally yields lower fare prices while Sundays. The one day during the week you don't want to purchase your flight on is Friday. Travelers who purchase their tickets on Fridays are more likely to buy tickets. For instance, according to Expedia's Travel Hacks Report, Sunday is the best day of the week to find cheaper flights—and has been for the past 5 years. According to Expedia and the ARC, Sundays are the best days to be buying your flights - you can often save up to 13% from the Friday price - with Tuesday being. You can even check for flights departing today. To find the cheapest fares, it's usually best to book at least a few weeks in advance for domestic flights and a.

Is Shopify Or Godaddy Better

Both GoDaddy and Shopify provide extensive customer support and resources. Shopify's 24/7 customer service is renowned in the industry, while GoDaddy offers a. Features: Shopify's flexibility is impressive. Its abundant app marketplace allows for easy customizations. Although not as feature-full, Godaddy is. For ecommerce, Shopify may be a better option. Compare Shopify vs GoDaddy Website Builder for Irish businesses. GetApp provides a side-by-side comparison with details on software price, features and. Shopify is the winner. It supports over 14 different payment methods, including various digital wallets. Meanwhile, GoDaddy has fewer payment options. Reporting. Overall, both Shopify vs Godaddy are perfect and useful for ecommerce merchants so it's very hard to claim which is better than the other. Depending on the. So GoDaddy Website Builder vs. Shopify – which one is a better fit for your project? If you plan on running a growing eCommerce store and want all the features. Features, Shopify, Godaddy ; First Year Cost, High, Lower ; Cost After First Year, Steady, High ; Domain Privacy, Free, Paid ; Domain Settings Setup, Easy, Easy. Shopify vs GoDaddy: summing up. For me, Shopify is technically the better platform — all its ecommerce features are stronger than the GoDaddy. Both GoDaddy and Shopify provide extensive customer support and resources. Shopify's 24/7 customer service is renowned in the industry, while GoDaddy offers a. Features: Shopify's flexibility is impressive. Its abundant app marketplace allows for easy customizations. Although not as feature-full, Godaddy is. For ecommerce, Shopify may be a better option. Compare Shopify vs GoDaddy Website Builder for Irish businesses. GetApp provides a side-by-side comparison with details on software price, features and. Shopify is the winner. It supports over 14 different payment methods, including various digital wallets. Meanwhile, GoDaddy has fewer payment options. Reporting. Overall, both Shopify vs Godaddy are perfect and useful for ecommerce merchants so it's very hard to claim which is better than the other. Depending on the. So GoDaddy Website Builder vs. Shopify – which one is a better fit for your project? If you plan on running a growing eCommerce store and want all the features. Features, Shopify, Godaddy ; First Year Cost, High, Lower ; Cost After First Year, Steady, High ; Domain Privacy, Free, Paid ; Domain Settings Setup, Easy, Easy. Shopify vs GoDaddy: summing up. For me, Shopify is technically the better platform — all its ecommerce features are stronger than the GoDaddy.

GoDaddy Website Builder has reviews and a rating of / 5 stars vs Shopify which has reviews and a rating of / 5 stars. Compare the. Shopify offers better value and more e-commerce features, especially with its entry-level plan. Here's What You Get for Free. GoDaddy offers a day free. When it comes to fraud protection, WooCommerce and GoDaddy rely on third-party extensions for fraud prevention, while Shopify provides first-party fraud. GoDaddy is a solid platform with plenty of benefits, but it can't match Shopify's ecommerce capabilities. Shopify's integrability, simplified POS solutions, and. To summarize the two, Shopify is best for users who want lots of inventory control, and are looking to build a complex online store. On the. Do you find GoDaddy or Shopify to be more worth it in terms of marketing? For ecommerce, Shopify may be a better option. Upvote 6. Downvote. To put it simply, Shopify is the better option for users who need extensive inventory control and who want to create a sophisticated online business. GoDaddy. However, GoDaddy offers more than just online shopping because of its flexible templates, improved marketing resources, and cheaper startup costs. . We've. Comparing pricing between Shopify and GoDaddy Website Builder is tough because they have two very different products. This comes from the fact that Shopify. Their system is very intuitive, and they are heavily investing in constantly making their platform better. The biggest selling point years ago was the ability. Which approach is better? GoDaddy offers reliable support for technical issues, with phone support being a highlight, which is great for those who prefer direct. GoDaddy, while offering some customization options, cannot match the depth and breadth of customization offered by Shopify. However, GoDaddy may be better for. Shopify and GoDaddy both charge monthly fees but, unlike Shopify, GoDaddy offers a free mobile-friendly website option with support and marketing tools — but. The optimal approach to switching from GoDaddy to Shopify is choosing a reputable eCommerce migration service provider like LitExtension. With ,+. As per my opinion Shopify is the better platform for eCommerce site. Your response. GoDaddy, a giant in domain registration and web hosting, ventured into website creation and e-commerce solutions. Shopify, on the flip side, has embedded itself. Are you a vendor? Why Capterra is free. 15 years helping Irish businesses choose better software. Home · eCommerce Software; Shopify vs GoDaddy Website Builder. Which approach is better? GoDaddy offers reliable support for technical issues, with phone support being a highlight, which is great for those who prefer direct. The vital difference is that when it comes to more comprehensive and sophisticated dashboard of the sales, orders, and traffic, Shopify takes the upper hand. Shopify. Worth it. I have run 7 figures on both Wordpress / woocommerce and Shopify and will never stray from Shopify again.